Online SIP Calculator

Investing in a systematic manner with SIP is a good approach to maximize wealth.

Every individual has some financial goals which he aspires to achieve and in order to achieve those goals one has to invest. There are various investment avenues available in the market today which one can opt for. However, among them, mutual funds are the most beloved and preferred instruments. Mutual funds allow an individual to invest either in a lump sum or through SIP in any giver scheme.

LUMPSUM - An investor can put a onetime amount in any particular mutual fund scheme. For example, if you are purchasing any mutual fund scheme for any amount as on a particular date. Mr. A purchases IDFC core equity fund for Rs. 10,000 on 01-Jan-2020 is a perfect example. Now, the mutual fund house will allot certain number of units based on a NAV (net asset value) of that day in exchange of Rs. 50,000. After this, the mutual fund house buys securities and finally the investors' money will start growing subject to market dynamics.

SIP - SIP stands for systematic investment plan. It allows an investor to invest a certain fixed amount of money on regular intervals on a fixed date for a fixed tenure. It is like recurring deposit in a bank/post office.This helps the investors in systematically accumulating the small amounts of money for their fulfillment of future goals. It also helps the investors in their monthly savings through proper budgeting.By saving a small sum of Rs. 1500 in a monthly mode for 30 years at 15% p.a. return will give 1 crore ( approx.) to the investor. In equity investments, patience and discipline is required to get the high yearly returns.

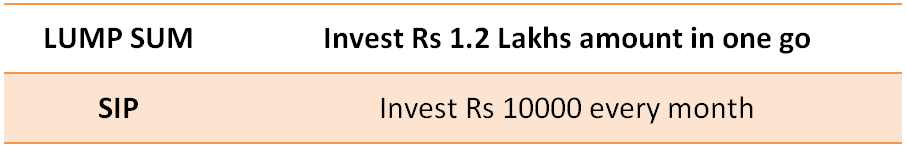

For e.g. if an investor wants to invest Rs 1.2 lacs in a mutual fund scheme then he can invest it in the following manner:-

What are the Benefits of SIP?

- Rupee cost averaging - Investing through SIP in a monthly mode helps in averaging out of monthly investments because the equity market will go up and down, so sometimes you buy units at high NAV and sometimes at low NAV which ultimately averages out your purchasing amount.

- Help an individual in riding through volatility with ease - Since, you are buying units every month, it helps in reducing the volatility of your investments. If you are continuously running your SIP for 10 years or more, then the downside risks on your investments will be very less.

- One can invest even in a small amount - Through SIP mode, you can invest in mutual funds for as low as Rs. 100 per month.

- Suitable for small savings - This is the best instrument for small savings as you can participate in equity markets by investing a small amount of your savings.

- Helps in family budgeting - A salaried individual can budget their monthly income towards savings and expenses which finally leads to comfortable high number of accumulations of their savings which they can use for their children education, marriages, retirement etc.

- Helps in achievement of financial goal - An individual can invest their savings based on their financial goals. This way by investing small amounts for their different goals will help the investors in comfortable fulfillment of their goals.

How to find Investment Figure Through this SIP Investment Calculator?

You can use our online SIP calculator to find the corpus value you will get after investing say for 10 years. This will help an investor in knowing that whether they are investing the right amount which is sufficient for achieving their various financial goals or not.

The mutual fund sip return calculator also shows the amount of wealth gained by an investor over a period of time.

How To Use SIP Return Calculator?

There are just three simple steps which one has to follow in order to find the corpus value:

- One has to put in a figure which an individual is investing every month.

- Secondly, he has to select the period for which he is making investments.

- The last step is to enter the expected rate of return on your investments.

After punching in all the details in the online sip calculator, the investor will be able to see the value of its investment after a stipulated time period which is called CORPUS VALUE.

Further Reading: